What Income Is Needed for a $700K Mortgage?

Table Of Content

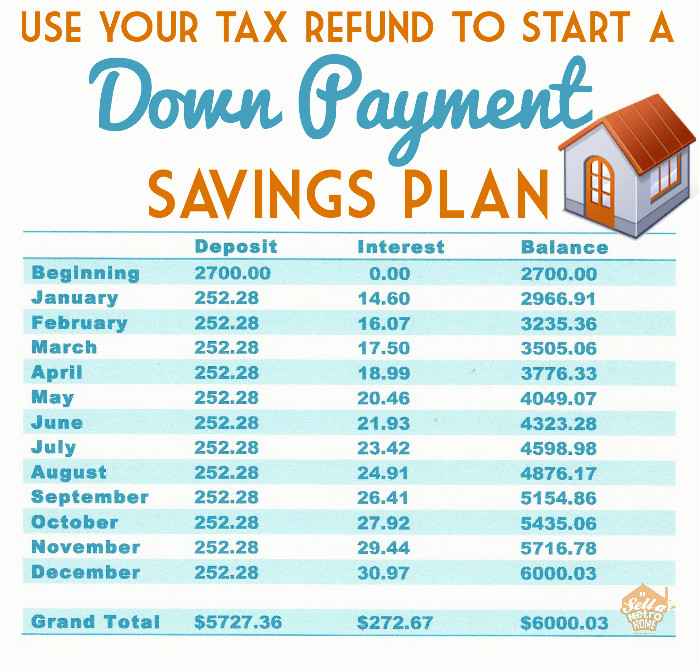

So by that measurement, we might consider this to be the minimum down payment for a “typical” home purchase in California, as of summer 2022. A few loan programs allow you to buy a house with no down payment, including VA and USDA loans. You may also ask your lender if gifted funds from family members or friends are allowed. Most people need short liquidity on their home savings (fewer than ten years) so it’s best to keep the funds out of investments that are risky or tie up your money for long periods. Instead, consider FDIC-insured accounts, like short-term CDs or high-yield savings accounts.

How To Get A No-Down-Payment Mortgage - Bankrate.com

How To Get A No-Down-Payment Mortgage.

Posted: Mon, 08 Apr 2024 07:00:00 GMT [source]

How To Buy A House With No Money Down

Though there are a number of advantages to a 20% down payment, it sometimes makes sense to make a smaller down payment. Figuring out the appropriate size of a down payment on a house is a common challenge for home buyers. We’ve got answers to a few frequently asked questions to help you make the right decision. Let’s examine the advantages and disadvantages of a 20% down payment on a house.

VA Loans: 0% Down

Government-backed USDA loans make rural and low-income home ownership more accessible. In today's world where everything is done online, people still need one-on-one advice via phone. Yes, the more money you put toward a down payment, the less you need to borrow. Figure out what you can save each month, both for your down payment and to build up how much you should have in your emergency fund.

Second homes and investment properties: 10 percent to 25 percent

The income needed to afford a $700,000 home largely depends on where you live. You can save money on moving by DIYing tasks that can be done safely, such as packing and cleaning. If your landlord allows it, consider bringing in a roommate temporarily if you are stuck in an expensive lease. By splitting the rent, you can save more money towards your dream of home ownership. Take care of any high-interest debt and other obligations before you start saving for a house. New venture capital firms, like Fifth Wall Ventures, have begun a dedicated approach to investing in real estate technology startups that are transforming what they refer to as the "Built World".

What are Mortgage Closing Costs? - NerdWallet

What are Mortgage Closing Costs?.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

This program was created by the U.S. government in 1944 to help people returning from military service purchase homes. Catch up on CNBC Select's in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. A bigger down payment also translates to more equity in the home to start — a tappable asset, as well as a potential safeguard against any declines in home values. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. See if you qualify for these ways to help you stretch your savings.

Business services

We’ll also discuss the average amount buyers pay upfront so you can get an idea of what to expect on your journey toward homeownership. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. You may be able to buy a house with no down payment if you qualify for a down payment assistance program.

Fortunately, with the wide range of home loans available in today’s market, it’s possible to buy a home with as little as 3% down. You can even put 0% down if you qualify for a down payment assistance program, a VA loan or a USDA loan. The size of your down payment doesn’t need to deter you from buying a home. However, several of the most affordable state-level and local markets have seen an increase in median down payments as a percentage of the sales price. Conversely, some of the priciest markets see declining down payment amounts as the crunch in home affordability continues. Home buyers are posting smaller down payments in most housing markets since home prices peaked in the fourth quarter of 2022 and are decreasing through 2023 year-to-date.

Calculate mortgage rates

It’s possible to get a mortgage with a credit score below 620, particularly with an FHA loan, but you’ll need to put down a higher amount upfront — 10 percent. With other mortgages, though, a lower credit score likely won’t give you access to the most competitive rates, if you qualify. A salary of $100k is above the national median income (according to Census data, the national median income was $74,580 in 2022). This is a good salary, but you still might struggle to buy a home in areas with a high cost of living.

For instance, you may start by transferring a portion of each paycheck into a savings account. Saving for a down payment can be overwhelming since it’s a considerable cost. Here are several tips and tricks to find the funds you need to buy a house.

A smaller down payment will get you into your home quicker and leave you more money to cover repairs and insurance and to invest in other financial goals. By 2005, the median down payment was only 13%, according to a Washington Post analysis of National Association of Realtors data. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point. Your down payment plays a role in determining your loan-to-value ratio, or LTV. To calculate the LTV ratio, the loan amount is divided by the fair market value determined by a property appraisal.

Many lenders recommend a DTI below 43%, but some programs allow a maximum of 50%. Additionally, having a good credit score of 670 or above helps you qualify for lower rates and fees, as lenders perceive less risk. Two potential reasons for the higher median deposit are that buyers have more purchasing power and also want a lower monthly payment due to higher mortgage rates. In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C. Has the highest down payment percentage amount at 20.4%, with a $100,800 median down payment due to the area’s expensive housing market. A higher down payment helps reduce your monthly mortgage payments, which can keep your DTI at a reasonable level.

Comments

Post a Comment